79 Resources Ltd., (Stock Exchange:N/A), NI 43 101, May 5th, 2020

- Technical Report for Louise Lake Property, Cu, Mo, Au, calc-alkaline suite porphyry system, British Columbia

- No Resources Estimated

SUMMARY

1 INTRODUCTION

In August 2019,

79 Resources Ltd. (79) of Vancouver, British Columbia, Canada, commissioned

Aurora Geosciences Ltd. (Aurora) to complete a National Instrument 43-101

Technical Report on the Louise Lake property. This is a “Property of Merit”

based on the presence of the “Main Zone” copper (Cu) - molybdenum (Mo) - gold

(Au) - silver (Ag) porphyry deposit in the north-central area of the property.

The Louise Lake

property is located 35 air-km west of the Town of Smithers, British Columbia,

Canada. The property comprises eight mineral claims comprising 1,825.12

hectares (Ha) held by Messrs. Steven Scott and Brian Scott. In July of 2019, 79

Resources Ltd. (“79”) entered into an option agreement to gain a 75% interest

in the property. In August 2019, “79” commissioned Aurora to conduct

due-diligence mapping and rock sampling across the surface expression of the

Main Zone, and to conduct preliminary surface exploration southeast of the

Louise Lake waterbody. In November, a Phase 2 program of ground magnetometer

surveying, centered on the “Argillic Hill” area, was completed.

The southern part

of the property is accessible by logging roads extending west from Smithers,

although the Main Zone is accessible by helicopter only. Terrain is gentle to

moderate in the Main Zone area, but considerably more rugged in the

southeastern area. The property is located along the inland limit of the coastal

pacific climatic influence, while to the east, the climate trends towards a

sub-arctic continental climate.

Despite a history

of significant exploration including delineation-style diamond drilling from

1970 through 2008, there are no environmental liabilities on the property. The

2019 program required no permitting. However, proposed diamond drilling

programs for 2020 will require permitting from the Department of Energy, Mines

and Petroleum Resources, Government of British Columbia, Canada. A security

bond will also be required once the program is permitted.

2 HISTORY

The present

property area was first staked as the LOU claims in 1968 by Mastodon-Highland

Bell Mines (Mastodon). In 1969, Mastodon completed geological mapping, soil

geochemical and Induced Polarization (IP) geophysical surveying and trenching,

the latter exposing a 490 m X 245 m area of low-grade Cu-Mo mineralization,

called the “Main Zone”, north of the Coal Creek fault.

Late in 1969,

Canadian Superior Exploration Ltd. optioned the property, and in 1970,

completed a 17-hole, 2,021 m diamond drilling program, with 16 holes focusing

on or close to the Main Zone. Results were deemed sub-economic and the claims

were allowed to lapse.

In 1975, Granby

Mining Corporation re-staked the area as the 500-hectare (ha) LOUISE 1 and 2

claims and conducted soil geochemical surveying in 1976, delineating a 650 m X

300 m Cu soil geochemical anomaly.

In April 1979,

the Bethlehem Copper Corporation staked the ROB 1-4 claims, resampled earlier

core and conducted further geochemical and limited IP surveying. The

geochemical survey returned two strongly anomalous Mo values, including one

northwest of Bud Lake. However, the ROB claims were allowed to lapse.

In late November

1979, the LOUISE LAKE claim was transferred to Noranda Exploration Company Ltd (Noranda)

which conducted airborne magnetometer and VLF-EM surveying across the Louise

Lake area. anomalous Cu and Au values from the Main Zone area.

The property was

re-staked in 1986 as the 1,600-ha TENN and TROUT claims by E. Shaede and L.

Warren who then optioned it to Lacana Mining Corporation in 1987, which changed

its name to Corona Gold Corporation (Corona) by 1988. In 1988, Corona conducted

reconnaissance and detailed geological mapping and soil, rock and silt

sampling, identifying numerous Cu ± Mo ± Au anomalies proximal to, but not

always directly overlying, the Main Zone.

In 1989, Corona

completed a five-hole, 916-metre diamond drilling program in the eastern Main

Zone area. All holes returned strongly anomalous Cu-Au ± Mo mineralization with

fairly uniform metal values but lacking notable high-grade zones. In 1989,

Placer Dome Inc. (Placer) conducted a brief property visit followed by a

detailed compilation of existing drill and surface data. Placer determined that

mineralization at Louise Lake has both epithermal and porphyry-style

characteristics, suggesting the Main Zone represents a transitional zone

between upper-levels of a porphyry system and an evolved hydrothermal (epithermal)

zone. Placer believed the Main Zone mineralization to be sub-economic and thus

declined to enter into an acquisition of the property from Corona.

Corona terminated

its option in early 1991. In November 1991, the claims were optioned by New

Canamin Resources Ltd. (New Canamin), who then subsequently entered into an

option with Equity Silver Mines Ltd (Equity). In 1992, Equity conducted two

diamond drilling programs totaling 2,651.6 metres in 13 holes, interpreting

drill results as representing an east-west trending tabular deposit, dipping

shallowly northward. At a 0.2% Cu cut-off, Equity stated that the deposit

contained “estimated resources of 50 million tonnes grading 0.3% Cu and 0.3 g/t

Au with some payable molybdenum”. This is not a compliant resource under NI

43-101 standards and should not be relied upon. Equity drilled one hole to the

east, and intersected a zone referred to as the “Lake Zone”, comprising

chalcopyrite-sphalerite veins with accessory Au and Ag values.

By early 1995,

Global Mineral and Chemical Ltd. (Global) entered into an option agreement to

earn a 100% interest on the TENN and TROUT claims and conducted soil geochemical

sampling. A moderate Zn-in-soil geochemical anomaly was identified about 350 m

south of Louise Lake. In early 1996, Global conducted IP surveying followed by

five diamond drill holes into the Main Zone area. No assessment reports were accessible;

however, news releases stated that two holes were mineralized throughout their

>200-metre extents. In 1998, Global drilled five additional holes to the

east. No major zones were intersected although the company did announce

“interesting but not exciting silver values”

The LOUISE 1-30

claims were staked by January of 2004 by Messrs. B. Kreft and C. Greig. In

January 2004, Firestone Ventures Inc. (Firestone) entered into a joint venture

agreement to obtain a 100% interest in the property and completed a six-hole,

1,718.4 m diamond drilling program focusing on the Main Zone. The program

expanded known dimensions of the zone to the east and west, and confirmed

previously reported results in central areas.

In December 2004,

Firestone signed a “letter of intent” with North American Gem Inc. whereby

North American Gem may earn a 75% interest in the property. In 2005, North

American Gem conducted a sevenhole, 2,412.3 m diamond drilling program,

focusing on further expansion of the Main Zone to the west, east and at depth.

“Main Zone” and surrounding area. This program determined the base of the

deposit to be a flat-lying thrust fault, named the “Terminator”. Results of

this and all earlier programs were incorporated into thefirst Main Zone NI

43-101 resource estimate, provided by SRK Consulting (Canada) Inc. (SRK). In

July, SRK released its estimate, comprising an Indicated Resource of 6.0M

tonnes grading 0.214% Cu, 0.006% Mo, 0.20 g/t Au and 0.98 g/t Ag, and a further

Inferred Resource of 141M tonnes grading 0.234 % Cu, 0.009% Mo, 0.23 g/t Au and

0.94 g/t Ag. A bulk density of 2.75 tonnes/m3 was utilized. No mineral reserves

were included in the resource evaluation. Despite some sources of uncertainty,

SRK determined that the exploration work, including the 2006 program, was done

in “a professional and reliable manner”.

In late July of

2006, a 164-kg composite sample of re-split core was sent for metallurgical

analysis to G & T Metallurgical Services of Kamloops, British Columbia,

Canada. “Head grade” analysis by G & T stood at 0.28% Cu, 0.3 g/t Au and

0.007% Mo, showing a fair correlation with the weighted average of analytical results

by ALS Chemex. Copper mineralogy comprised an even distribution of chalcopyrite

and enargite. The resulting concentrate contained 28.9% Cu at an 85% recovery

rate, 0.650% Mo at an 80% recovery rate, 18.7 g/t Au, at a 55% recovery rate,

and 364 g/t Ag, at a 44% recovery rate. The concentrate also contained 11.4%

arsenic (As), a “deleterious element”, initiating research by North American

Gem into alternative extraction processes. The final concentrate has a “mass

percent” of 0.8% of the original flotation feed.

In 2007, North

American Gem conducted a drilling program comprising 6,330.4 metres in 21

holes, focusing on deposit expansion as well as resource upgrading of the Main

Zone. The program effectively outlined the deposit size and tenor, and returned

the first intersection of Main Zone-style mineralization underlying the

Terminator to the northwest. The latter suggested the underlying “sub-Terminator”

portion occurs to the west-northwest, and the known Main Zone is hosted by a

rafted block offset to the east.

In early 2008,

North American Gem conducted a 16-hole, 5,042.8-metre diamond drilling program focusing

on potential deep-seated “sub-Terminator” mineralization to the west. This

program successfully identified the sub-Terminator zone and determined that

post-depositional flat-lying faulting converted the deposit into a series of

tabular blocks, each overlying unit successively displaced farther to the

east-southeast.

The property was

expanded by spring 2008, and a surface exploration program comprising

geological mapping and geochemical sampling was conducted across the entire

expanded property area. Results suggested some potential for a second

porphyry-style system, centered in the Bud Lake area southeast of the Louise

Lake waterbody. A detailed surface field program, based at Bud Lake, was

recommended, but no further surface work was done by North American Gem.

The area covering

the Main Zone deposit was acquired by Messrs. Steven Scott and Brian Scott in

2017. They allowed the property to lapse in 2018, then re-staked the core area.

A single two-unit claim, covering the northeast part of the Main Zone, was

acquired by an independent interest in October of 2018. As of January, 2020,

this claim has not been optioned to “79”.

3.GEOLOGICAL SETTING

AND MINERALIZATION

Geological

Setting

The Louise Lake

property is located within the Stikinia Terrane of the Intermontane Tectonic

Belt. The Stikinia Terrane consists largely of mid-late Jurassic Hazelton Group

sedimentary and lesser volcanic units, Bowser Assemblage clastic sediments, and

early to mid-Cretaceous Skeena Group volcanic and sedimentary units. This

stratigraphy has been intruded by the granitic Topley Intrusions, occurring

along the axis of the Skeena Arch, a major northeast-southwest trending

transverse uplift structure. The Louise Lake property is located near the

western limit of the Skeena Arch, which has also undergone block faulting and

some thrust faulting. Eocene Nanika Intrusions, consisting of quartz-feldspar

porphyritic granite, quartz monzonite and granodiorite, with minor rhyolite and

quartz porphyritic stocks, have intruded all layered stratigraphy.

The Louise Lake

property occurs along the east-northeast trending regional-scale Coal Creek

lineament, forming the contact between lower Cretaceous Skeena Group sediments

and volcanics to the northwest, and lower to middle Jurassic Hazelton Group

volcanics and sediments to the southeast. The area north of the Coal Creek

lineament is underlain by roughly east-west striking andesite flows and tuff to

fragmental units, intercalated with conglomerate to sandstone units, with

lesser greywacke and siltstone. Volcanic units occur primarily in the

mineralized “Main Zone” area, where they have been intruded by several

east-west trending, moderately north-dipping slabs of feldspar porphyritic

monzonite. Mapping and drill log analysis revealed a larger quartz monzonitic

stock west of the Main Zone. A small unit of argillically altered

quartz-feldspar porphyritic monzonite occurs towards the Coal Creek lineament. Another

feldspar porphyritic monzonite stock hosting up to 12% disseminated pyrite

occurs northeast of the Main Zone.

South of the Coal

Creek lineament, Hazelton Group stratigraphy comprises a dominant NNW – SSE trending

assemblage of variably feldspar porphyritic basalt to andesite flows, and

lesser tuff and agglomerate. This assemblage is intercalated with abundant

rhyolitic flow units, variably porphyritic, and described as latite in

year-2008 mapping. Two units of fairly monomictic conglomerate occur near the

“terminus” of the driveable forest access road.

Mineralization

Two separate

mineralized prospects occur within the core area of the Louise Lake property,

the Main Zone deposit and the Lake Zone. The Main Zone is a tabular deposit

dipping from 30˚ to 40˚ to the north, and has been traced along strike for

about 1,000 metres. It comprises two major horizons extending at 80˚ – 260˚:

the shallower lower grade “North Horizon” and the underlying much broader,

higher-grade “South Horizon”. The Lake Zone, occurring about 1.2 km to the east

along the north shore of Louise Lake, hosts vein and fracture-hosted

zinc-silver mineralization.

Block modeling in

2006 by SRK indicated the deposit has a footprint in plan view of almost 500

metres, extends to a depth to almost 300 metres, and showed that central

portions have lower copper-equivalent grades than western and eastern portions.

The geological setting comprises a series of several tabular units of feldspar

porphyritic monzonite separated by sedimentary units in central areas, and

andesite fragmental units in northern and western areas. Mineralization occurs

within both the intrusion and host volcanic and sedimentary strata; grades do

not appear to be dependent on a specific lithology.

Mineralization at

the Main Zone comprises fine-grained disseminated and vein-controlled

sulphides. The sulphide grains consist of an almost even mixture of

fine-grained chalcopyrite and enargrite (a Cu-As sulphide) locally comprising

up to 4% of the rock mass. Several pulses of vein stockwork emplacement have

occurred, with quartz-pyrite veins crosscut by later nearly massive pyrite

veins. Copper-gold ratios show an approximate deposit-wide average ratio of 1%

Cu: 1 g/t Au. Mo-bearing quartz stringers occur on surface in the eastern Main

Zone area and in basal portions of the western area. Silver values reported from

drill core analysis are generally less than 2.0 g/t.

Interpretation of

2004 through 2006 results and including previous results, indicated the Main

Zone is bounded by a basal flat-lying fault at depths to 300m, called the “Terminator”

with a minimal displacement of several hundred metres. North-dipping

mineralized zones are truncated by this flat-lying fault, forming a

wedge-shaped northern terminus.

Feldspar-porphyritic

monzonite units are most abundant in central and eastern portions of the Main

Zone. In western areas the primary host is andesite tuff to fragmental rocks,

with minor host conglomerate and sandstone. The highest copper and gold grades occur

in these areas, returning values to 0.592% Cu with 0.586 g/t Au across 35.7

metres, and locally exceeding 0.800% Cu and 0.800 g/t Au. The 2007 program identified

higher-grade gold mineralization at depth in northeastern areas, overlying the

Terminator fault. The Au: Cu ratio is considerably higher than the 1:1 ratio

occurring throughout most of the deposit. Lowgrade sub-Terminator

mineralization intersected to the northwest in 2007, was found to have metal

ratios and rock fabric similar to outlying areas of the Main Zone.

A single hole

targeting the projected underlying portion of the Main Zone to the

east-northeast, somewhat west of the Lake Zone, intersected minor massive

lead-zinc veining at depth.

The 2008 drilling

focused partly on delineating sub-Terminator mineralization west-northwest of

the Main Zone. Several holes confirmed the presence of a flat lying slab of

sub-Terminator-hosted Main Zone-style mineralization. In all intercepts, the

sub - “Terminator” mineralization was truncated by another flat-lying mylonitic

fault, called the “Sub-Terminator fault”. The westernmost hole returned

low-grade mineralization below the “Sub-Terminator” having similar grade ratios

to Main Zone mineralization, indicating another mineralized slab extends

farther west-northwest.

4 DEPOSIT SETTINGS

The Main Zone is

classed as a “calc-alkaline suite” porphyry system, similar to deposits of the

Eocene Babine Igneous Suite. The primary exploration model is porphyry-style

mineralization, although potential satellite occurrences of base metal veining,

“Bonanza-style” gold veins and zones of gold +/- silver bearing epithermal

mineralization are also viable targets.

A typical

porphyry deposit setting comprises bulk-tonnage-style Cu-Mo-Au mineralization

centred on, and emanating from, a feldspar porphyritic monzonitic to granitic

intrusion. Core areas consist of intrusivehosted disseminated copper sulphides,

largely chalcopyrite and bornite, commonly with accessory molybdenite and gold.

Mineralization is spatially associated with the core intrusion, but not

necessarily confined to it. Stocks are typified by concentric zones of

potassic, phyllic (sericitic) and propylitic alteration, and commonly

associated with argillic (clay) alteration and overlying zones of advanced

argillic alteration.

Outbound from the stock,

mineralization in the central deposit becomes progressively associated with quartz vein,

stringer and stockwork infilling of fracture and breccia zones formed during

intrusion emplacement. Farther outbound, a progression of concentric “halos” of

disseminated pyrite, followed in turn by halos of lead-zinc-silver veins,

bonanza veins and finally epithermal mineralized zones, typifies many porphyry

systems. “Epithermal” deposits refer to those resulting from deposition of

highly evolved hydrothermal fluids. These commonly occur distally from the core

intrusion, and are the most outbound mineralized zones. Epithermal

mineralization includes chalcedonic quartz vein, stringer and stockwork zones

and hot springs-derived mineralization.

At Louise Lake,

“epithermal” mineralization may be broadened to include hydrothermal

mineralization in general, and include vein, vein stringer and vein stockwork

zones. Mineralization may also include tabular, commonly intrusion-hosted

stratabound deposits comprising fine stockwork-hosted and/or disseminated mineralization

confined to a specific lithological horizon. The tabular shape is due to

stratigraphic or structural controls. The Main Zone deposit may represent a

transitional deposit model type between a typical porphyry system and outlying

vein deposits. Copper mineralization was originally believed to be tennantite

(also a Cu-Fe-As sulphide), which would have signified upper levels of a

porphyry system. The revised mineralogy renders the location of the Main Zone

respective to the overall setting of the porphyry system as uncertain.

5 CURRENT EXPLORATION

(2019)

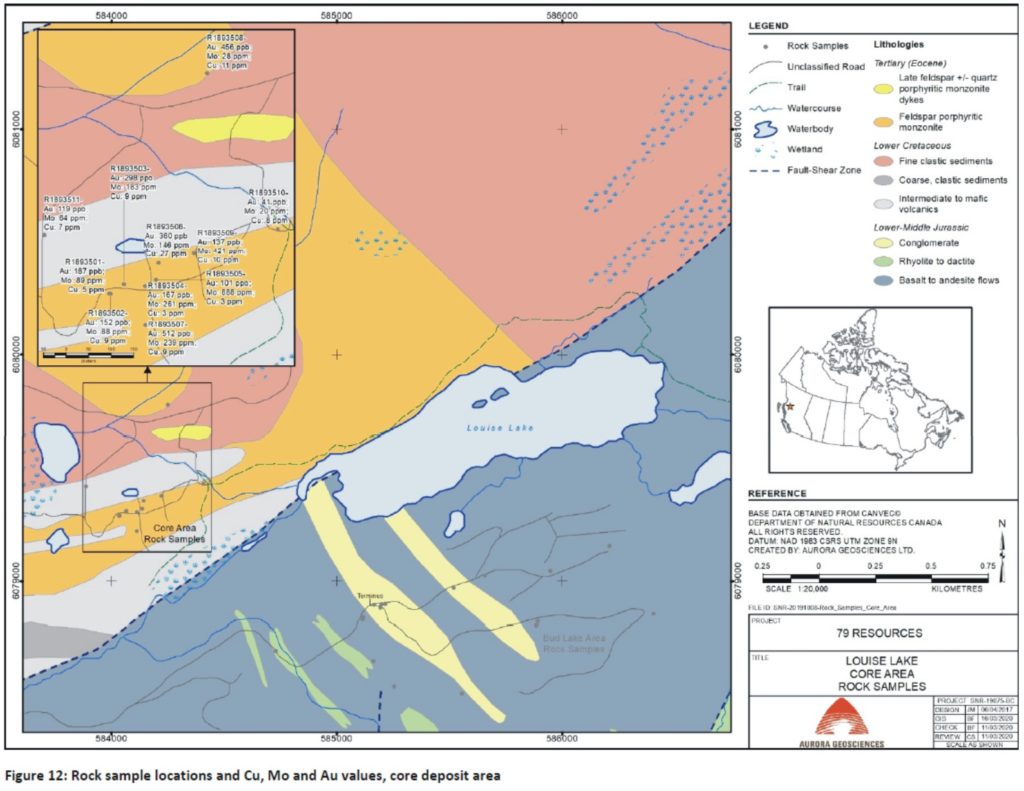

Phase 1 of the

2019 program comprised a one-day due-diligence visit to the Main Zone area, and

eight days of exploration across the southeastern area, within the LOUISE

EXTENSION claim. Exploration across the southeastern area comprised geological

mapping, rock sampling, and soil geochemical sampling along existing and former

logging roads. All work was done by a two-person crew, commuting on a daily

basis from Smithers, and included two heli-supported traverses.

The one-day

due-diligence visit confirmed the presence of Main Zone-style Cu-Mo-Au-Ag

mineralization, although grades were somewhat lower than those documented from

the Main Zone deposit. The remaining traverses failed to identify significantly

mineralized zones or major geochemical anomalies, although elevated Mo and

arsenic (As) values were returned from rock sampling of pyritic conglomerate units

near the terminus of the driveable logging road. Fairly widespread fine-grained

pyrite, associated with fractured to brecciated mafic volcanics, occurs near

the former logging roads.

Phase 2 comprised

a ground magnetic surveying program along east-west oriented lines centered on “Argillic

Hill”, an area of argillic (clay) alteration and pyritization in the southwest

property area. A total of 52.7 line km, including 3.45 line km of north-south

tie lines, was surveyed. The survey identified a NE-SW trending magnetic low

feature, which may represent a significant structural lineament. This separates

fairly linear magnetic signatures to the east from more arcuate features to the

west, possibly representing folded stratigraphy accreted onto to more linear

stratigraphy to the southeast of the lineament. The survey also revealed an

ovoid magnetic high signature coincident with “Argillic Hill” alteration

directly west of the magnetic low feature.

6 CONCLUSIONS

The Main Zone of

the Louise Lake deposit is a tabular body striking at 260˚ and dipping from 30o

to 40o to the north. The zone comprises disseminated and vein-associated grains

of chalcopyrite and enargite with late molybdenite-bearing quartz veining,

occurring within a series of tabular units of feldspar porphyritic monzonite

separated by sedimentary and volcanic units. The deposit model is an

upper-level portion of a Cu-Mo-Au-Ag porphyry system. By 2006, the Main Zone

was known to have dimensions in plan view of about 1000 m by 500 m, extending

to the horizontal “Terminator” fault at a depth of almost 300 m. Mineralization

does not appear to show any lithological preference, although improved

correlation of geological data is recommended.

In 2006, SRK

released the first NI 43-101 resource estimate. The estimate comprised an

Indicated Resource of 6 M tonnes grading 0.214% Cu, 0.006% Mo, 0.20 g/t Au and

0.98 g/t Ag, for a copper equivalent (CuEq) grade of 0.369%; and an additional

Inferred Resource of 141 M tonnes grading 0.234% Cu, 0.009% Mo, 0.20 g/t Au and

0.94 g/t Ag, for a CuEq grade of 0.426%. No reserves were included in this

resource estimate.

Later in 2006, a

metallurgical study by G & T Metallurgical Services Ltd. indicates that the

concentrate, with a “mass percent” of 0.8, contains 28.9% Cu at a recovery rate

of 85%. The concentrate also includes 0.650% Mo at an 80% recovery rate, 18.7

g/t Au, at a 55% recovery rate, and 364 g/t Ag, at a 44% recovery rate. Arsenic

(As) concentration was 11.4%, limiting potential for treatment by conventional

extraction techniques. A number of alternative extraction processes were

investigated in 2006, although no further progress has occurred since then.

Concentrations of other deleterious elements were minor.

A scoping study

by SRK, submitted in January 2008, indicated the project was not economically

viable at projected long-term metal prices, specifically a Cu price of

US$1.35/lb. At a Cu price of $3.00/lb, project economics improve, but economic

viability remained doubtful. North American Gem chose to respect the results,

and terminated the scoping study. Prices for Cu, Mo, Au and Ag in 2019 have

improved significantly, even when factoring inflation since early 2008, buoyed

by a favourable CDN$: US$ exchange rate. Long term price forecasts are required

when re-evaluating project economics.

The 2008 drilling

program successfully identified the underlying “fixed” portion of the deposit

to the westnorthwest. Another flat-lying fault, called the “Sub-Terminator”,

forms the basal unit of a mineralized tabular block. At least one other tabular

block occurs beneath this to the west. Thus, the original deposit has been

segmented into a series of blocks, each overlying segment successively

displaced farther to theeast-southeast. The Main Zone is hosted by the

easternmost single block which extends to surface.

Results from the

2008 summer surface exploration program revealed an area of quartz and

carbonate vein stockwork east of Bud Lake, with elevated Au values from nearby

stream silt sampling. A second prospective target is the “Arsenic Hill” area

northwest of Sandstone Lake. The “Louise Extension” claim currently covers

these targets.

Due diligence

rock sampling in 2019 across the surface expression of the Main Zone confirmed

the presence of Cu-Mo-Au-Ag mineralization, although the 2019 values are lower

than the deposit average. Geological mapping in the Bud Lake area did not

identify mineralization indicative of another porphyry centre, and no

significant mineralized zones were identified. Several rock samples of

conglomerate returned elevated Mo and As values and slightly elevated Cu

values. However, this is not considered a significant exploration target. The

“Argillic Hill” occurrence was not visited in 2019.

The Phase 2

ground magnetic survey identified an ovoid magnetic “high” feature, directly

west of the main NE-SW magnetic low feature, coincident with an area identified

in 2008 comprising argillic alteration, pyritization, and several elevated

gold-in-soil geochemical values. This may represent the overlying halo exploration

target.

7 RECOMMENDATIONS

It is strongly

recommended that 79 Resources acquires the claim (#1064060) held by Mr. B.

Kreft, through an option or purchase agreement. This claim covers part of the

Main Zone deposit and is required if the entire deposit is to be wholly-owned.

The 2020 program

is recommended to comprise two phases. Phase 1 would target the Argillic Hill occurrence,

and comprise a surface program of grid soil geochemical sampling, combined with

detailed geological mapping, rock sampling and prospecting. This program would

require a 4-person crew based from a field exploration camp. The program would

have a total duration of 12 days, including 6 days of actual field work, 2 days

of mobilization and de-mobe, and 4 travel days. Total Phase 1 expenditures, including

10% contingency, are estimated at about CDN$103,200.

The Phase 2

program would comprise a single 350-metre due diligence-style hole targeting

the Main Zone, designed to confirm the extent and tenor of Main Zone

mineralization. This phase would be completed using a single drill with two

shifts per 24 hours. The crew would be comprised of four drillers and three geological

and geotechnical staff. Drilling could be done in late winter, allowing for

travel across frozen wetlands if necessary, or in summer, if wetlands can be

avoided. None of the proposed drilling or support logistics would take place on

Claim #1064060. Phase 2 expenditures, including 5% contingency, are estimated

at about CDN$180,500. Proposed expenditures exclude payment for a necessary

reclamation bond but include reclamation costs. Expenditures also exclude PST

and the cost of acquiring Claim #1064060.

Dodaj komentarz