Seabridge Gold Inc., (NYSE:SA, TSX:SEA), NI 43 101 May 7th, 2020

- Ksm (Kerr-Sulphurets-Mitchell) Prefeasibility Study And Preliminary Economic Assessment Update, Porphyry Cu, Au, Mo, Northwestern British Columbia,

- Resources Estimate Update

- Reserves Estimate in 2016 PFS

SUMMARY

1

INTRODUCTION

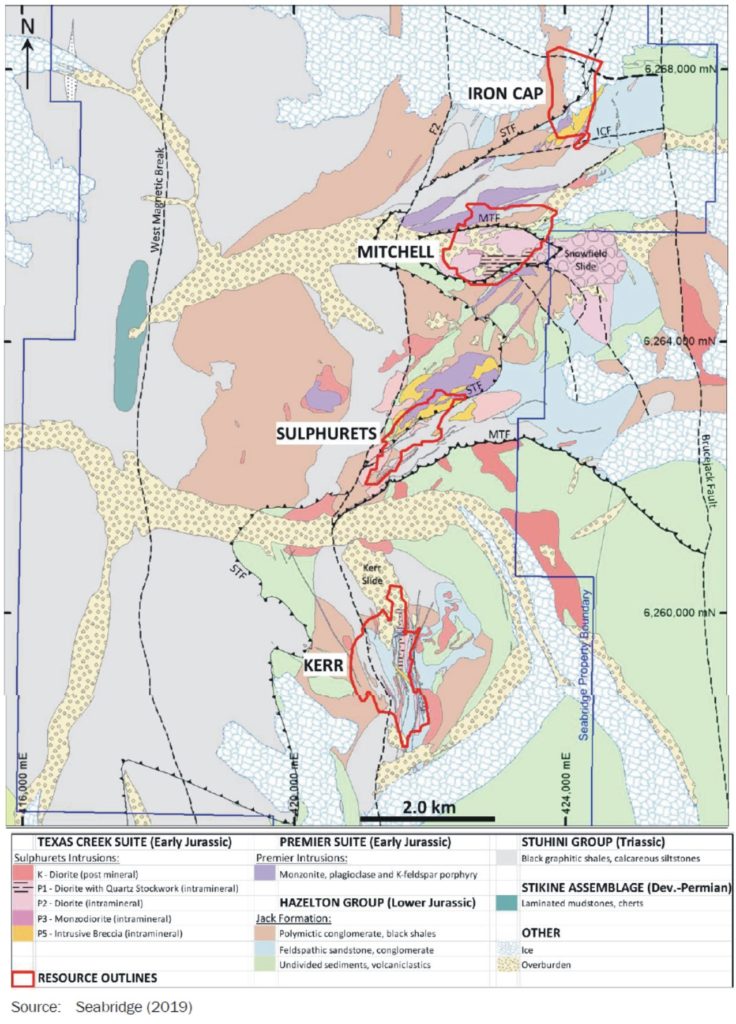

Seabridge Gold Inc.’s (Seabridge) Kerr-Sulphurets-Mitchell (KSM) Property

(the Property) involves the development of major gold-copper deposits located

in northwest British Columbia (BC) off Highway 37, approximately 65 km by air

north-northwest of the ice free Port of Stewart, BC. The Property is situated

within the coastal mountains of BC, approximately 30 km topographically

upgradient of the Alaska-BC border. KSM is one of the few undeveloped projects

in the world that has received its environmental approvals, these having been

granted by both the Government of Canada and the Government of BC. KSM includes

four major mineralized zones, identified as the Mitchell, Kerr, Sulphurets, and

Iron Cap deposits. The deposits contain significant gold, copper, silver, and

molybdenum mineralization. Figure 1.1 is a panoramic view looking east towards

the aforementioned deposits.

In conjunction with the environmental approvals,

Seabridge also received early-stage construction permits for KSM from the

Province of BC in September 2014. The permits issued include:

- authority to construct and use roadways along Coulter Creek and Treaty Creek

- rights-of-way for the proposed Mitchell-Treaty Twinned Tunnel (MTT) alignment connecting KSM facilities

- permits for constructing and operating various camps required to support construction activities

- permits authorizing early-stage construction activities at the mine site and Tailings Management Facility (TMF).

Seabridge also received permits from the BC Government

in October 2016, which allows the construction of an exploration adit to

explore mineralization associated with the Deep Kerr deposit.

In this report, this “KSM (Kerr-Sulphurets-Mitchell)

Prefeasibility Study and Preliminary Economic Assessment Update, NI 43-101

Technical Report” (the Report), the KSM mine development has been evaluated

with two alternative studies that each evaluate different options for mine

development. The 2016 Prefeasibility Study (2016 PFS) evaluated mining mostly

by open pit method at a specified processing rate, while the 2020 Preliminary

Economic Assessment (2020 PEA) is an alternative study that leverages the

technical information of the previous studies and evaluates mine development

dominated by underground mining methods at a processing rate significantly

higher than that used in the 2016 PFS.

The results of the economic analyses for the 2016 PFS

and 2020 PEA represent forward-looking information that is subject to a number

of known and unknown risks, uncertainties and other factors that may cause

actual results to differ materially from those presented in this Report.

Forward-looking statements in this report include, but are not limited to,

statements with respect to future metal prices, the estimation of Mineral

Resources and Mineral Reserves, the estimated mine production and metals

recovered, the estimated capital and operating costs, and the estimated cash

flows generated from the planned mine production for the different development

options. The material factors or assumptions used to develop the

forward-looking information are identified in the relevant sections of this

Report.

2 KEY STUDY OUTCOMES

The 2016 PFS and the 2020 PEA are

stand alone studies. The results of the 2016 PFS remain valid and represent a

viable option for developing KSM, with the 2020 PEA assessing an alternative

development option at a scoping level. The 2020 PEA does not impact the 2016

PFS. The 2020 PEA is preliminary in nature and includes Inferred Mineral

Resources that are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be categorized as

Mineral Reserves, and there is no certainty that the results of the 2020 PEA

will be realized. Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

The results of the 2020 PEA were

disclosed in Seabridge’s press release entitled “Updated PEA Study Enhances

Seabridge Gold’s KSM Project”, dated April 27th, 2020. The Report will be filed

in support of the disclosure of the 2020 PEA results.

2020 PRELIMINARY ECONOMIC ASSESSMENT

Wood Canada Limited (Wood) and the following

independent consultants have prepared an updated Preliminary Economic

Assessment study (the 2020 PEA):

The 2016 PFS envisaged a combined open pit/underground

block caving mining operation that is scheduled to operate for 53 years. During

the initial 33 years of mine life, the majority of ore would be derived from

open pit mines, with the tail end of this period supplemented by the initial

development of underground block cave mines. Ore delivery to the mill during

Year 2 to Year 35 is designed to be maintained at an average of 130,000 t/d.

After depletion of the open pits, the mill processing rate would be reduced to

just over 95,000 t/d for 10 additional years before ramping down to just over

60,000 t/d for the remaining few years of stockpile reclaim at the end of the

mine life. Over the entire 53-year mine life, ore would be fed to a flotation

and gold extraction mill. The flotation plant would produce a

gold/copper/silver concentrate for transport by truck to the nearby sea port

for shipment to Pacific Rim smelters. Extensive metallurgical testing confirms

that KSM can produce a clean concentrate with an average copper grade of 25%

with a high gold and silver content, making it readily saleable. A separate

molybdenum concentrate and gold-silver doré would also be produced at the KSM

processing facility.

All dollar figures presented in this report are stated

in US dollars, unless otherwise specified. The 2016 PFS concluded:

- the estimated Proven and Probable Mineral Reserves as of July 31, 2016 are 38.8 Moz

of gold and 10.2 Blb of copper (2.2 Bt at an average grade of 0.55 g/t gold and

0.21% copper per tonne). - projected initial capital costs are US$5.0 billion and sustaining capital costs are

US$5.5 billion estimated to a +25%/-10% level of accuracy and incorporate

substantial enhancements to meet environmental improvements that were committed

to in the environmental assessment (EA) review process - the 2016 Base Case after-tax NPV at a 5% discount rate is US$1.5 billion with an IRR of

8% and payback period is approximately 6.8 years of a 53-year operating mine

life, using three-year average price assumptions of US$1,230.00/oz gold,

US$2.75/lb copper, US$17.75/oz silver, US$8.49/lb molyebdenum and a foreign

exchange rate of US$0.80 per Cdn$1.00 - overall, the 2016 PFS confirmed that KSM is an economic project with an unusually long

life in a low-risk jurisdiction.

2020 PRELIMINARY ECONOMIC ASSESSMENT

Wood Canada Limited (Wood) and the following independent consultants

have prepared an updated Preliminary Economic Assessment study (the 2020 PEA):

- MMTS

- Golder

- KCB

- BGC

- Brazier

- ERM.

The 2020 PEA has been prepared as an alternative

option to the 2016 PFS for the KSM development. The 2020 PEA was undertaken to

evaluate a different approach to mine development by emphasizing low cost block

cave mining early in the production plan and reducing the size of the open

pits, which reduces the surface disturbances in the re-designed mine

development. The 2020 PEA assesses the potential impacts of incorporating

higher grade Inferred Mineral Resources delineated at Iron Cap and Deep Kerr

into the mine design, and increasing the annual average mill throughput from

130,000 t/d envisioned in the 2016 PFS to 170,000 t/d in the 2020 PEA.

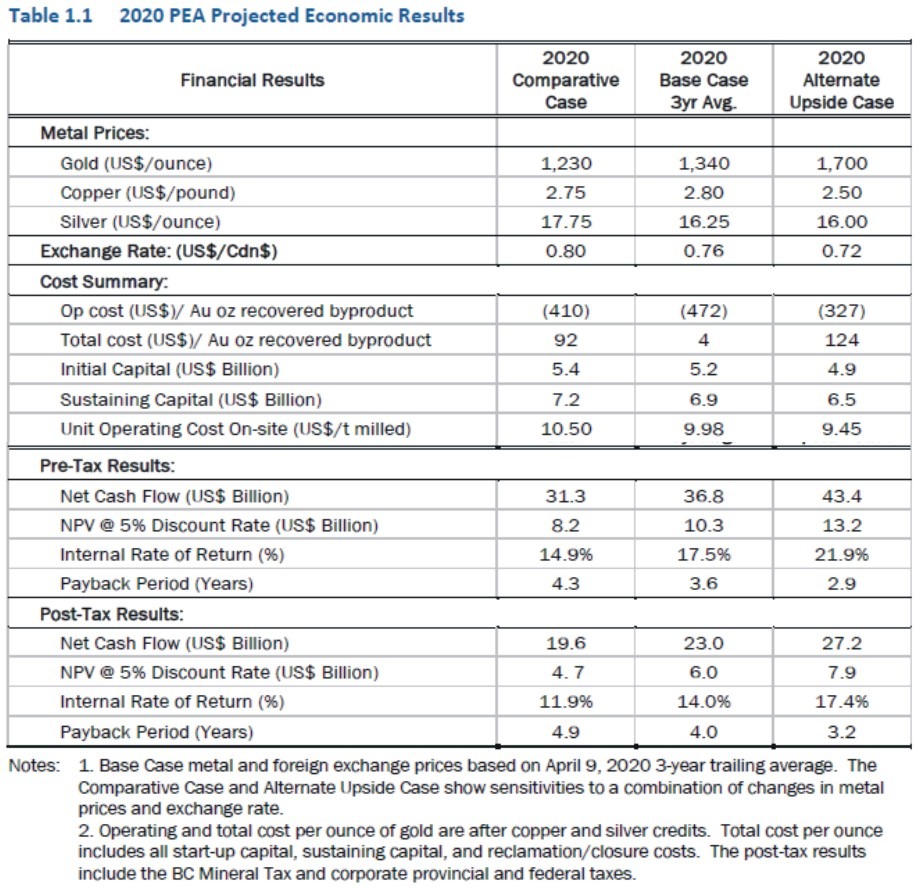

The key 2020 PEA outcomes for the projected economic

results are presented in Table 1.1. The 2020 PEA show improvements over the

2016 PFS in unit operating costs, net cash flow, NPV, IRR and project payback

by producing a higher percentage of mill feed through underground mining, and

processing the mill feed at a higher plant throughput rate. Annual gold and

copper production in the 2020 PEA increase over those shown in the 2016 PEA

through the benefit of applying an improved variable cutoff strategy to early

mining, improved mine sequencing and achieving this with reduced initial and

sustaining capital.

The material factors or assumptions used to develop

the forward-looking information in the 2020 PEA, as well as the material risk

factors that could cause actual results to differ materially from the

forward-looking information are more fully described in Section 24 and 25 of

the Report. A portion of the Mineral Resources in the 2020 PEA mine plans,

production schedules, and cash flows include Inferred Mineral Resources, that

are considered too speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral reserves,

and there is no certainty that the 2020 PEA will be realized. Due to the

conceptual nature of the 2020 PEA, none of the Mineral Resources in the 2020

PEA have been converted to Mineral Reserves and therefore do not have

demonstrated economic viability.

3 PROPERTY DESCRIPTION AND LOCATION

The Property is located in the coastal mountains of

northwest BC at a latitude and longitude of approximately 56.50° north (N) and

130.30° west (W), respectively. The Property is situated approximately 950 km

northwest of Vancouver, BC; 65 km by air north-northwest of Stewart, BC; and 21

km south-southeast of the former Eskay Creek Mine. The proposed pit areas lie

within the headwaters of Sulphurets Creek, which is a tributary of the Unuk

River, which flows into the Pacific Ocean through Alaska. The proposed TMF will

be located within the tributaries of Teigen and Treaty creeks. The Teigen and

Treaty creeks are tributaries of the Bell-Irving River, which is itself a major

tributary of the Nass River. The Nass River also flows to the Pacific Ocean

through the northwestern portion of British Columbia, entirely within Canadian

jurisdiction. Figure 1.2 is a general location map of the Property.

The Property comprises four discrete claim blocks. The

claim blocks are referred to as:

- the KSM claims

- the Seabee claims

- the Tina claims

- the Treaty Creek Switching

- Station claims

The four KSM claim blocks include 79 mineral claims

(cell and legacy) and 2 mining leases with a combined area of 40,784.97 ha.

There are also 17 KSM placer claims held by KSM Mining ULC covering part of the

KSM claims. The placer claims secure rights in a historically designated placer

district. The Claim Group Inc. (TCG) acts as agent on behalf of Seabridge with

respect to maintaining all pertinent records associated with the Property

tenures. All claims and leases are in good standing under the Mining Tenure

Act of BC and are recorded as owned 100% by KSM Mining ULC, a wholly owned

subsidiary of Seabridge.

Annual holding costs for all leases and claims vary by

year depending on whether the fees are paid in cash or the value of work

completed on developing the claims is used in lieu of a cash payment. Over the

next five years, the annual cash holding costs to keep the claims and leases

valid range between Cdn$450,000 to Cdn$970,000. Those estimated costs can be

reduced significantly if work expenditures are applied in lieu of cash fees. No

additional permits are required to address the recommendations in this report;

part of the expenditures for that work can be applied in lieu of cash fees.

Seabridge believes they have addressed all issues to secure access, mineral

title, and ability to perform work on the property and are not aware of any risks,

other than those identified in this Report, that could materially affect

proposed work plans.

- the Seabee claims

- the Tina claims

- the Treaty Creek Switching

4 GEOLOGICAL SETTING AND MINERALIZATION

The Property lies within “Stikinia”, a long-lived volcanic island-arc terrane that was accreted onto the Paleozoic basement of the North American continental margin in the Middle Jurassic.

Early Jurassic sub-volcanic intrusive complexes are

common in the Stikinia terrane, and several host well-known precious- and

base-metal-rich hydrothermal systems. These include copper-gold porphyry zones

such as Galore Creek, Red Chris, Kemess, Mt. Milligan, and KSM.

The Kerr deposit is centered on an Early Jurassic,

north-south trending, steep westerly dipping tabular intrusive complex.

Drilling demonstrates that the recognized mineralized system has an overall

strike extent of 2,400 m, a width of approximately 800 m, and a vertical extent

of at least 2,200 m. Deep drilling since 2012 has identified two sub-parallel,

north-south trending, steep west-dipping mineralized zones approximately 1,700

m long that appear to coalesce near the topographic surface. The west limb is

up to 500 m thick, while the east limb is up to 300 m thick. After significant

deep drilling was completed at the Kerr deposit, an updated geological

interpretation and subsequent updated Mineral Resource model were completed.

That new model forms the basis for the 2019 Mineral Resources and Mineral

Reserves. Approximately 223 diamond core holes totaling about 85,000 m of

drilling data were used to construct the Kerr block model used for this Report.

Sulphurets is a structurally complex deposit

intersected by numerous east-vergent faults associated with the mid-Cretaceous

Skeena fold and thrust belt. The deposit is composed of stacked thrust fault

panels made up of Upper Triassic Stuhini Group and Lower Jurassic Hazelton

Group volcano-sedimentary strata that are intruded by a number of dykes and

stocks. The majority of mineralization occurs in the “Lower Panel”, that was

historically divided into several discrete mineralized zones, including, from

southwest to northeast: the Canyon zone, Breccia Gold zone, and Raewyn

Copper-Gold zone. The main body of the Sulphurets deposit has a lensoidal

geometry, dipping approximately 30 degrees to the northwest with a horizontal

extent of 2,200m, down dip extent of 550 m, and a true thickness of up to 330

m. Approximately 139 core holes totaling about 45,000 m were used to construct

the Sulphurets block model used for this Report.

The Mitchell Zone (Figure 1.4) is underlain by

foliated, schistose, intrusive, volcanic, and clastic rocks that are exposed in

an erosional window below the shallow north dipping Mitchell Thrust Fault

(MTF). Mineralization at the Mitchell deposit is genetically and spatially

related to the Early Jurassic Mitchell intrusive complex, which is composed of

Sulphurets (Texas Creek) suite diorite, monzodiorite, and granodiorite stocks

and dykes. The intrusive complex cuts sedimentary and volcanic rocks of the

Upper Triassic Stuhini Group and sandstones, conglomerates, and andesitic rocks

of the Lower Jurassic Jack Formation (basal Hazelton Group). The Mitchell

complex has been subdivided into three major intrusive phases. The successive

intrusive phases were accompanied by the development of different hydrothermal

assemblages, veining and mineralization. The Mitchell deposit features many

characteristics typical of gold-enriched calc-alkaline porphyry copper

deposits. Metals, chiefly gold and copper are generally at low concentrations,

finely disseminated, stockwork or sheeted veinlet controlled and pervasively

dispersed over hundreds of metres. Grades diminish slowly over large distances,

distinct from the Sulphurets and Kerr zones. The basis for Mitchell Mineral

Resources is the block model that was used in the 2016 PFS (Tetra Tech, 2016).

That model was constructed using drilling data collected through 2011. Since

that model was completed, 23 holes were drilled within the Mitchell resource

area, although only 8 holes intersected estimated Mineral Resources based on

the end-of-year 2011 block model. Grade comparisons between the 8 new holes and

the end-of-year 2011 Mitchell block model showed no material differences

between the new holes and the estimated block grades.

The Iron Cap deposit is the northernmost porphyry gold-copper-molybdenum

deposit in the KSM district, and occurs structurally above the Mitchell

deposit, in a panel of rocks located between the Mitchell Thrust Fault and

Sulphurets Trust Fault. The deposit is hosted by an Early Jurassic intrusive

complex that is roughly contemporaneous with intrusions located at the Mitchell

and Kerr zones. The intrusive complex is composed of multiple intrusion and

breccia phases, the earliest of which is a pre-mineral diorite. A second dioritic

phase located in the northwestern portion of the deposit is thought to be

syn-mineral and is spatially associated with some of the highest gold and

copper grades observed at Iron Cap. Mineralized hydrothermal breccias are

significantly more abundant and voluminous at Iron Cap than at Mitchell,

Sulphurets, and Kerr. The Iron Cap mineralized zone forms a tabular body

striking roughly north-south, dipping approximately -60 degrees to the west.

The deposit has dimensions of approximately 1,500 m along strike, 1,500 m down

dip, and up to 800 m in thickness. Mineralization remains open down dip. The

Iron Cap grade model was updated following the completion of the 2018 drilling

campaign. A total of 99 diamond core holes totaling about 62,000 m were used in

the update.

5

MINERAL RESOURCES

The 2019 Mineral Resource estimate is the current and only Mineral

Resource estimate used in this Report.

Mineral Resources were estimated for the Property by

Resource Modeling Inc. (RMI). The four mineralized zones, Kerr, Sulphurets,

Mitchell and Iron Cap, were modeled within a single block model using 25m x 25m

x 15m blocks. As more understanding was gained after each annual drilling campaign,

individual block models were created for each area. Grade interpolation

parameters have also evolved over time, reflecting changes required for

modeling deeper mineralization intersected below the Kerr and Iron Cap

deposits. A variety of basic descriptive statistics and spatial analyses were

completed for each area upon the completion of annual drilling campaigns. These

investigations include the generation of grade distribution tables, grade

histograms, cumulative probability plots, grade box plots, grade contact plots,

down-hole variograms, and directional variograms. In addition, new drill hole

results were typically compared against the previous grade model to assess

model performance.

RMI established the Mineral Resources for the various

KSM mineralized zones using constraining conceptual open pit and block cave

shapes which were used to establish reasonable prospects for eventual economic

extraction as outlined in the CIM Definition Standards for Mineral Resources

and Mineral Reserves (CIM, 2014). The following gold, copper, silver, and

molybdenum metal prices were used for determining block NSR values,

US$1,300/oz, US $3.00/lb, US $20.00/oz, and US $9.70/lb, respectively. Open pit

and underground mining costs of Cdn$1.80/tonne and Cdn$6.00 to Cdn$7.00/tonne

were used to establish conceptual open pit and underground resource shapes,

along with a processing and G&A cost of Cdn$9.00/tonne.

The conceptual open pit and underground mining shapes

were generated for each resource area based on calculated block model NSR

values. The NSR values were generated for each deposit. MMTS generated

conceptual pits for the Kerr, Sulphurets, and Mitchell deposits using

MineSight® software and Lerchs-Grossmann algorithms. Golder developed

conceptual block cave footprints using the block NSR values and Geovia’s PCBC™ Footprint

Finder software. The footprint polygons were extruded vertically based on

guidance from Golder.

The draw point extraction elevations were extruded

vertically to create 3D solids that were used for resource tabulation.

Conceptual caves were clipped against surface topography (Iron Cap) or

conceptual resource pits (Kerr and Mitchell). Mineral Resources are determined,

at Cdn$9 and Cdn$16 NSR cutoffs for open-pit constrained and underground mining

constrained resources, respectively.

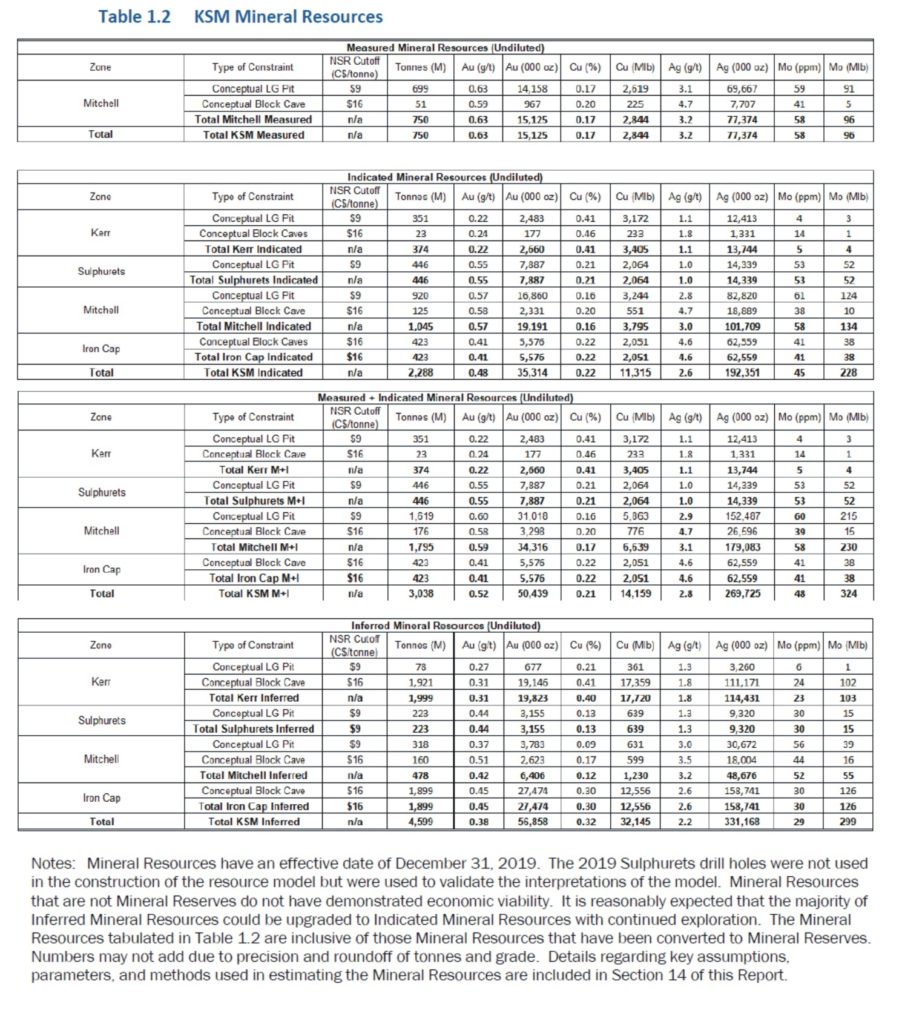

Table 1.2 summarizes the estimated Measured,

Indicated, and Inferred Mineral Resources for each zone.

6 MINERAL RESERVE ESTIMATE

Mineral Reserves estimate was In the 2016 PFS

7 MINE PRODUCTION PLAN

During the initial 33 years of

mine life, the majority of ore is derived from open pits, with the tail end of

this period supplemented by the initial development of underground block cave

mines. After Year 1 ramp up, ore delivery to the mill from Year 2 to Year 35 is

designed to be maintained at an average of 130,000 t/d. After depletion of the

open pits, the mill processing rate will be reduced to about 96,000 t/d for 10

additional years, before ramping down to just over 61,000 t/d. The change in

throughput matches the production levels from the block cave with appropriate

ramp ups and ramp downs applied. The remaining few years use stockpile reclaim

to supplement the declining production from the block caves at the end of the

mine life.

The topographic relief in the areas of the open pits, block cave mines,

and the Rock Storage Facilities (RSFs) requires specific geotechnical

consideration. Conservative designs, alternative/mitigating scenarios, and

extra data and analyses have been included in the mine designs.

Potential geohazards have been identified in the area

of the proposed open pits, block cave mine, RSFs, roads, and other

infrastructure; designs include the mitigation of geohazards such as avalanche

control, provision of avalanche run-out routes, barriers, and avalanche area

and slope hazard avoidance as appropriate.

The mining progression is designed to build RSFs in

lifts (bottom-up construction) to consolidate the foundations and reduce

downslope risks. Final RSF configurations are designed with terraces at “as

dumped” angle of repose, with flat benches between terraces. The overall slope

angle is between 26° and 30° to provide the ability for re-sloping to accommodate

the end land use and reclamation plan.

Ore is mined from Mitchell open pit from Years 1 to 24. Mitchell transitions to block cave mining as the Mitchell pit is mined out. Ore is mined from Sulphurets open pit from Years 1 to 17. Kerr open pit supplements block cave mining from Year 25 to Year 34, and during these years, ore will be transported by an overland conveyor and rope conveyor system starting at the Kerr pit. Mitchell block cave is estimated to have a production ramp-up period of six years, steady state production at 20 Mt/a for 17 years, and then ramp-down production for another 7 years. Iron Cap is estimated to have a production ramp-up period of four years, steady state production at 15 Mt/a for 10 years, and then ramp-down production for another 9 years. The underground pre-production period would be six years, with first underground ore production from Mitchell and Iron Cap in Years 23 and 32, respectively. Figure 1.6 shows the 2016 PFS Open Pit LOM general arrangement.

Dodaj komentarz